First Quarter Re-Cap

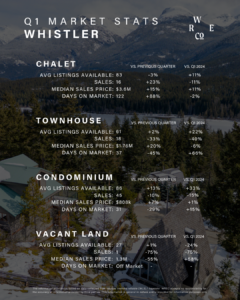

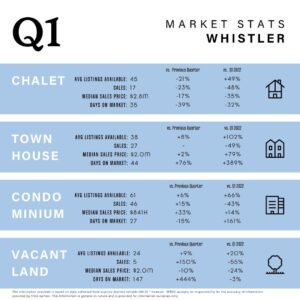

The first quarter of the Whistler market is off to a slower start this year, with 106* sales, down 23% from the 130* sales in Q1 last year. Inventory has continued to rise, with a total of 241* listings coming to the market. Overall inventory currently sits at 326* units, up 21% from the end of 2024 and 12% from the same time last year. The median sale price was up vs 2024 Q4 across the single family, townhome and condo categories. Overall, the Whistler market is currently leaning in favour of buyers. Coupled with lower mortgage rates, savvy buyers will recognize this might very well be the best time to make a move. Historically, the real estate market in Whistler has been a safe bet to ride out economic turbulence. With no foreign buyer ban, no foreign buyer taxes and no vacancy/speculation taxes, we are particularly attractive as place to invest for both financial and lifestyle reasons. Please reach out if you would like to discuss the market or if you have any questions.

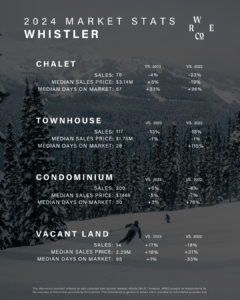

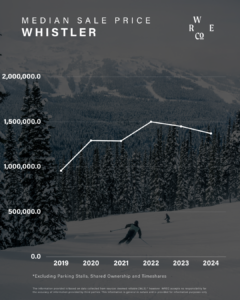

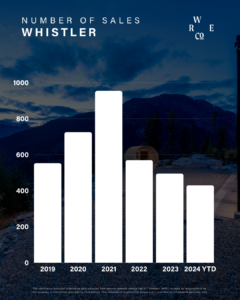

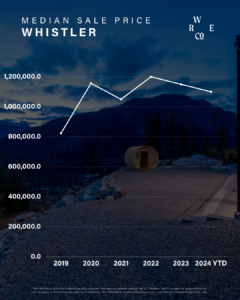

Looking back at 2024, the real estate market mirrored 2023 with similar sales activity. There were a total of 505* sales in 2024, which is a 2% increase in sales from 2023, but remains 29% below the 5-year sales average. Total sales dollar volume in the Whistler market was $826M, which despite the slight increase in sales from last year, is the lowest dollar volume we have seen since 2019 and 14% below the 10-year average. Prices remained fairly consistent across all product categories when compared to 2023. Regarding inventory, we saw a steady decline of available listings through the back half of the year and current inventory hovers around +/- 250 listings, which is relatively low in relation earlier in the spring when there were +350 listings following the announcement regarding the changes to capital gains tax.

Looking to 2025, we expect to see increased sales volumes that trends closer to historical averages, as mortgage rates are expected to continue to trend downward. We anticipate the favourable currency exchange rates will lead to an increase in tourism in the Sea-to-Sky region and, in turn, an increase in purchasers from the US and other countries this coming year as our region is a very desirable second home market.

Thinking of making a move? I would be happy to sit down and discuss the real estate market and how it pertains to your personal situation. Please reach out at your convenience or pop by my office at Whistler Real Estate Company in the village.

Marika Koenig

604.932.9590

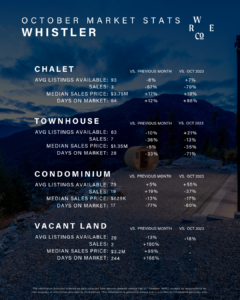

October marked a second consecutive month of increasing sales with 42 sales in Whistler. This is the highest sales volume the Whistler market has seen since May this year, as more buyers secured homes for the upcoming ski season.

Currently the market is slightly behind in Year to Date sales when compared to 2023. Inventory is slightly below from the peak this summer with 304 listings currently available. At present, the market still favours buyers, however with the anticipation of further interest rate decreases, we expect there to be a gradual shift into a more balanced market.

If you have any questions, please feel free to reach me. I would be happy to discuss the market and how it pertains to your situation, whether you’re a buyer or a seller.

Crisp air, snow dusted mountain tops and restaurant specials throughout the resort are a sure sign winter is on its way in Whistler! With just over a month to go before the start of the ski season, there is much anticipation that this year will be a big snow year – we sure hope so too!

On the real estate front, we are also anticipating that at some point interest rates will “move the dial” for the market. As you will read below, market sales activity is tracking on par with last year, however we do have more listing inventory available which does afford buyers more choice. Also worth noting is that Whistler’s market is relatively small and can turn quickly, so I would say if you are a buyer waiting on the sidelines now is good time to make a move. Prices have been fairly stable and this speaks to the type of owners in the resort who generally have no urgency to sell.

If you are thinking of either buying or selling, I would be happy to sit down and discuss the market and how it pertains to your situation. Feel free to call or drop by my office in the village at your convenience.

Whistler

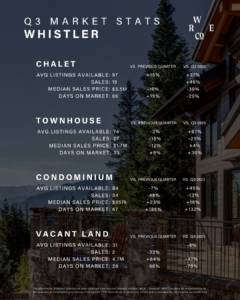

Despite a typical slow summer of sales, inventory levels declined slightly throughout the quarter. This came as a function of an almost 40% reduction in the number of listings coming to the market in Q3 vs Q2 (Note: there was a flurry of new listings that in the market back in April and May as a result of the capital gains changes that quickly slowed following the June 25 effective date). In Whistler, there were a total of 104 sales in Q3 spread fairly equally across July, August and a slight pick up in September. This was a 44% decline from the previous quarter, and a 4% decline when compared to the same quarter last year. The luxury segment also slowed down a bit in Q3 with 7 sales over $4M in Whistler and a top sale of $8.7M. Year-to-date buyers origin remains fairly typical, with 81% of purchasers from BC, and a slight increase in the number of US based buyers from 8% at the end of Q2 up to 10% on the year. Market inventory is currently sitting 20% above inventory at this time last year and 25% above the 5-year average. Overall, Q3 market conditions in Whistler leaned in favour of buyers.

Pemberton

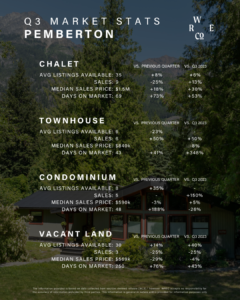

Both sales and inventory levels remained relatively steady in Pemberton throughout the quarter, with a slight slowdown in sales in September. There was a total of 27* sales in Q3, which was a 16% decline from Q2 sales volume but a 50% increase from Q3 of last year. This is likely a result of the three consecutive interest rate decreases we have seen since June along with the mounting consumer confidence that rates will continue to decrease throughout the end of the year and into next. There were 2 luxury sales in Pemberton over $2M, both of which came in August. Market inventory currently sits at 88 units, which is an overall 6% increase in inventory from the same time last year. However, when excluding vacant lots, inventory has actually decreased slightly versus September of last year. So far this year, Pemberton has seen 73% of buyers originating from either Whistler or Pemberton, and an additional 21% of buyers coming from the Lower Mainland and the remainder of BC. Overall, the Pemberton market also leaned in favour of buyers in Q3.

Summer has finally arrived! The heat has turned up, and so have the activities! There is so much to do in our mountain town at this time of year. We hope you can get outside and enjoy some of the many offerings or just enjoy some time with friends on one of the many outdoor patios in the village.

Regarding the real estate market, as you will read below, the market is also offering more opportunities for buyers with an increase in listing inventory. This is something we haven’t seen since before the pandemic. If you have been considering a purchase, I think this is a great time to be buying. Overall prices are holding and I don’t see much change going forward, as this speaks to the majority of sellers who have the financial stability to stay the course. It really comes down to finding the right property that meets your criteria. We are a small market, so there is never really an oversupply of listings.

If you are thinking of selling, correct pricing is imperative, as is ensuring you have the best possible presentation for your property. This is something we can help with. We are big proponents of staging and can assist sellers in getting their properties ready for the market.

Feel free to call or pop by the office in the village the next time you are in town to further discuss how we may assist you in your next real estate move. We love drop-ins!

Whistler

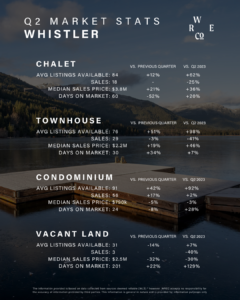

In Whistler, there were a total of 136* sales in Q2, with approximately half of these sales coming in the month of April. Overall, this is a 16% increase vs Q1, but down 18% from the same period last year. Despite sales volume declining over the course of the quarter, the median sale price increased each month as a result of the product mix sold. The luxury segment, although slower than Q1, remained active with 10 sales over $4M in Q2. Buyer’s origin for the first half of the year in Whistler was typical, with 83% of buyers coming from British Columbia, 2% from the rest of Canada, 8% from the US and 5% from other international locations. There was a listing boom likely due to the capital gains change, with 315 new units coming to market throughout the quarter. Total market inventory currently sits at 346 units, 50% above inventory at this time last year and 23% above the 5-year average. Overall, Q2 market conditions in Whistler were balanced, with a slight lean in favour of buyers.

Pemberton

There were 31* sales in Pemberton in Q2, almost doubling the sales volume from the typically slower first quarter of the year. Year-to-date, there have been 17 less sales than there were at the end of Q2 2023. Median sales prices are down across all categories, likely because of the continued sensitivity of the market to mortgage rates. Inventory increased by almost 40% from April to June and currently sits at 94 units, which is the highest level Pemberton has seen since August 2020. There was one luxury sale in Pemberton over the $2M price point in Q2 vs two in Q1. 37% of Pemberton buyers originated from Whistler, 33% from Pemberton, 16% from the Lower Mainland and 8% from other areas of BC. Overall, the Pemberton market tilted in favour of buyers throughout Q2.

Spring is in the air and in the mountains! With the winding down of the ski season, we are getting excited to switch over to all the summer activities the Whistler area has to offer. The local golf courses will all be open in the next few weeks, the bike trails are clearing of snow and the days are getting longer as we welcome the warmer weather.

On the real estate front as you will read below, the market has been stable through the winter, however with interest rates potentially dropping in the next few months, we should see a slight uptick in the market. We have already seen a few multiple offers in the nightly rental segment of the market, as Whistler’s tourist accommodation is somewhat of a safe haven and has not been affected by the recent provincial government changes on nightly zoned properties elsewhere in the province.

If you have any questions on the market or would like to discuss what options exist for your particular situation, whether you are thinking of buying or selling, feel free to call or drop by the office at your convenience.

Wishing you a fabulous spring!

Whistler

In Whistler, there were a total of 117* sales in Q1, with sales increasing for two consecutive months in January and February and a slight slow-down in March. Overall sales volumes were in line with the same period last year, however the year-to-date dollar volume is up 9% vs Q1 2023. This is reflective of notable activity in the luxury market, with 12 sales over $4M in the quarter. We are proud to share that Whistler Real Estate Company agents represented either the buyer, seller or both in 11 of those 12 transactions. There were also record-setting deals in the condo and land categories that closed in Q1, further reinforcing the continued strength in the luxury market in Whistler. Buyer’s origin for Whistler was fairly typical, with 81% of purchasers and 82% of dollar volume coming from Canada. There was a slight increase in dollar volume from US buyers, who represented 13% in Q1 vs 10% in 2023. Listings increased across all categories vs Q1 2023, with single-family and townhome inventory rising 65% and 31%, respectively. Overall, the Q1 market conditions in Whistler were balanced.

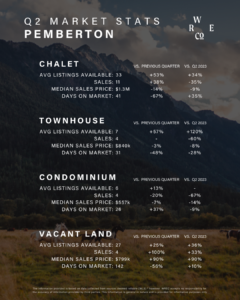

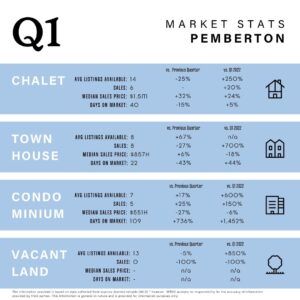

The Pemberton market saw 17 sales in Q1 – 4 chalets with acreage, 2 chalets, 4 townhouses, 5 condos and 2 parcels of vacant land. This is 13% increase in sales from Q4 of last year, but a 26% decrease year-over-year.

Median sales prices for single-family homes, condos and townhouses were up slightly when compared to both the previous quarter and the same period last year, likely as a result of mortgage rates starting to come down. In regards to luxury sales in Pemberton, there were 2 sales over the $2M in Q1. In terms of buyer origin, 82% of Pemberton buyers in Q1 were from Pemberton or Whistler, with the additional 18% coming from Vancouver and West Vancouver. Inventory increased from 61 to 73 units over the course of the quarter, including 24 vacant lots presenting the opportunity to build. Overall, the Pemberton market leaned in favour of buyers in Q1.

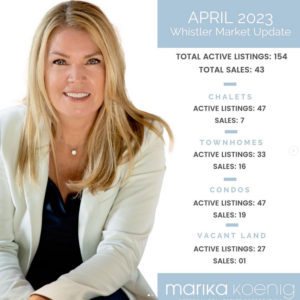

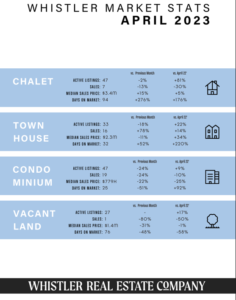

April’s numbers are in!

We’re still seeing a low in active listings and an increase in demand for homes in Whistler. As I mentioned last week in the market report this is causing an increase in home prices. This demand is causing highly competitive conditions for properties like townhomes.

Always feel free to reach out and chat with me about the current real estate conditions: 604-932-9590.

Whistler and Pemberton Excluded from Foreign Buyer Ban

After a surge in home buying during the pandemic, the Canadian government first announced a two-year foreign buyer ban would be brought in to help slow the real estate market in early 2022, which would take effect as of January 1, 2023. This ban would prevent non-Canadians and corporations controlled by non-Canadians from purchasing residential property in Canada, with some noted exceptions.

Whistler and Pemberton Excluded from Foreign Buyer Ban

As of December 21, 2022, we now have clarity that Whistler and Pemberton are excluded from this foreign buyer ban. Both Whistler and Pemberton fall outside the Prohibition on the Purchase of Residential Property by Non-Canadians Act definition of “Residential Property” – which states that the prohibition applies to ‘residential property located in a census metropolitan area or a census agglomeration’. We are happy to share that our real estate markets in Whistler and Pemberton will remain open to investment, despite the ban.

View the census tract reference maps here

Foreign Buyer Ban – Important Key Facts

- The Prohibition on the Purchase of Residential Property by Non-Canadians Act prevents non-Canadians from buying residential property in Canada for 2 years, starting January 1, 2023.

- This Act defines residential property as buildings with 3 homes or less, as well as parts of buildings like a semi-detached house or a condominium unit. The law does not prohibit the purchase of larger builders with multiple units.

- The Act has a $10,000 fine for any non-Canadian or anyone who knowingly assists a non-Canadian and is convicted of violating the Act. If a court finds that a non-Canadian has done this, they may order the sale of the house.

Canada’s Foreign Buyer Ban – Key Definitions

All of the below are defined under The Prohibition on the Purchase of Residential Property by Non-Canadians Act

Non-Canadian

This act applies to individuals who aren’t; Canadian citizens, permanent residents of Canada, persons registered under the Indian Act, corporations based in Canada that are privately held; not listed on the stock exchange in Canada, controlled by someone who is a non-Canadian.

Residential Property

This act defines residential property as buildings of up to 3 dwelling units and parts of buildings, like semi-detached houses or condominium units. This prohibition applies to; residential property located in a census metropolitan area or a census agglomeration.

Frequently Asked Questions: Canada’s Foreign Buyer Ban

When will the Prohibition on the Purchase of Residential Property by Non-Canadians Act come into force?

January 1, 2023. The prohibition will be in effect for a period of 2 years.

Who does the Prohibition on the Purchase of Residential Property by Non-Canadians Act apply to? The Prohibition on the Purchase of Residential Property by Non-Canadians Act applies to:

- an individual who isn’t a:

- Canadian citizen

- Permanent resident of Canada

- person registered under the Indian Act

- corporations based in Canada that are:

- privately held

- not listed on a stock exchange in Canada

- controlled by someone who is a non-Canadian

- entities formed under the laws of Canada or any Canadian province that are controlled by someone who is not from Canada

- an entity formed otherwise than under the laws of Canada or a province

Certain exceptions for specific groups of non-Canadians are outlined in the Regulations.

For more information on the Foreign Buyer Ban, please go here

B.C. Real Estate’s Cooling Off Period

Additionally, effective on January 1, 2023, the Cooling off Period is an unprecedented change to real estate contract law that creates the legal right to rescind a residential real estate contract in exchange for a fee. From the time the contract is finalized, buyers will have 3 days in which they can back out of the deal for a fee equal to 0.25% of the property purchase price.

There are no exceptions to this, for more information on how this will affect your home sale or purchase, please contact me 604-932-9590.

Here are the stats for the third quarter Whistler real estate market. Although sales have slowed down and listing inventory has increased, the inventory is still well below normal levels. It will be interesting to see what happens over the next 6 months when we are back into a normal ski season. The USD is strong and most of the market activity has been driven by the Canadian buyers the last 2 years. With international tourism expected to return in full swing, we will also likely expect more international buyers to return. Whistler is expected to be exempt from the Foreign Buyer Ban legislation which will be in place in most urban areas in Canada starting in January 2023 for the next 2 years. I think Whistler will be a stable and safe place for investment.

If you would like to discuss buying or selling in today’s market, please feel free to give me a call.

It’s no surprise that this listing flew off the shelf! Meticulously maintained and with a prime ski in/out location, it checks all the boxes for the most discerning buyers. We’re sure the new owners will enjoy this property for years to come. Listed at $6,999,000

Ski in/Ski out property ✅

Spacious 4 bedroom end unit floor plan over 3 levels ✅

Media Room✅

Beautiful mountain and forest views ✅

Private Garage ✅

Flexible Zoning ✅

Private Hot Tub ✅